Sam Dantzler

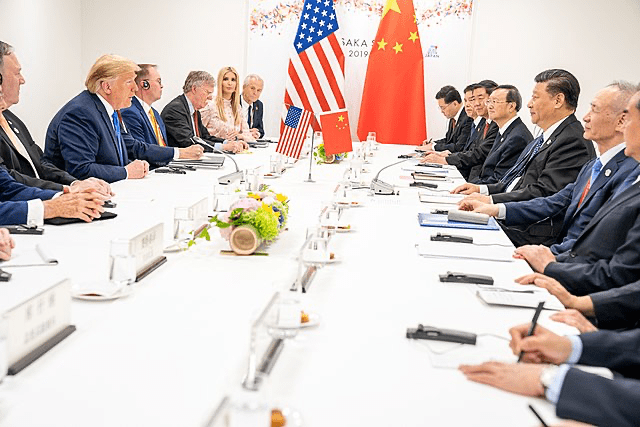

Following Election Day 2024 in the United States, China has braced for the impact of Trump 2.0. In the months between November 5th and Inauguration Day, Beijing’s leadership has been evaluating the outcome of Trump’s election and its implications on broader Chinese grand strategy. Trump’s first term was defined by aggressive diplomatic posturing and centering the Beijing-Washington relationship around trade relations, a dynamic that seems likely to continue in some degree as Trump returns to office. While Beijing certainly understands the mercurial nature of the Trump administration (based on his first term), an anticipated higher level of unpredictability has forced Chinese leadership to prepare for the next four years accordingly.

On February 1st, the Trump administration announced sweeping tariffs targeting Mexico, Canada, and China – reinforcing a key initiative Trump prioritized throughout his campaign and signaling a continuation of his first-term policies. The White House has stated that this set of tariffs is a response to the respective countries’ insufficient efforts in curbing both illegal immigration into the United States and the flow of fentanyl – and its precursor materials – that has contributed to the ongoing American drug epidemic. The Trump administration has since suspended the proposed tariffs on Mexico and Canada, citing that both countries have made the necessary concessions outlined in the original tariff ultimatum as negotiations continue. While the validity of the effect that Trump’s tariff threat actually had on these concessions is questionable at best, the Trump administration unsurprisingly claimed a political victory nonetheless.

Although tariffs on Mexico and Canada remain suspended, China continues to contend with the 10% tariff on all Chinese imports to the United States imposed by the Trump administration. The reaction from Beijing has been swift. On Monday, Chinese leadership criticized the Trump tariffs, asserting that they violated World Trade Organization rules. In response, China imposed retaliatory tariffs on a range of American imports, including coal, liquefied natural gas, and crude oil, as well as several other products within the energy and industrial sectors.

China was prepared for the reality that a second Trump would bring. Following Trump 1.0, Beijing sought to shift its grand strategy in a way that may mitigate the potential negative consequences brought on by a protectionist U.S. administration. China has begun to diversify and move away from a dependency on its American trade partnership by heavily investing in key domestic industries and looking for alternative international trade relationships. Specifically, China has begun to explore regional trade partnerships through mechanisms like the CPTPP, a free trade agreement between 11 countries in the Asia-Pacific area. Although China is not yet a member of the CPTPP, its desire to join highlights Beijing’s desire to diversify trade, as access to the American market is no longer guaranteed. In addition to institutional level interests, Chinese leadership has sought to strengthen ties with emerging trade opportunities in the Global South. Key partnerships in Southeast Asia and Latin America have become central to China’s investment strategy and bilateral engagement.

Just as Trump’s economic dealings with China have been and will remain unpredictable and transactional, so too will his stance on Taiwan. During his first term, Trump remained steadfast in supporting Taiwan, continuing a policy long upheld by previous American administrations. Although this support is likely to continue during this administration, Trump’s transactional approach to foreign policy may creep into the U.S.-Taiwan relationship. Recent rhetoric from Trump regarding Taiwan’s semiconductor production highlights this shift, as the President has once again threatened tariffs, accusing Taiwan of undermining U.S. chip production. This change in tone further exemplifies the disruption to American allies and global norms, underscoring the unpredictable nature of U.S.-Taiwan relations under Trump.

As President Trump begins his second term, the volatile nature of the Beijing-Washington relationship will persist over the next four years. China’s ability to navigate both the economic and diplomatic challenges posed by Trump’s unpredictable policies will remain at the heart of this dynamic. Beijing will certainly continue to adapt its grand strategy, further diversifying trade relationships and preparing for the shifting dynamics of U.S.-China relations under increasingly transactional American leadership.

Leave a comment